Why Tesla is Being Pumped: xAI Needs a Bailout

Musk is desperate to keep his AI startup alive, which is why the vote to allow Tesla to invest in xAI is urgent and more important than his $1 trillion pay package.

The stock ramp is for xAI: While Musk is orchestrating a sophisticated stock pump in Tesla ahead of its November 6th shareholders meeting, this is more for the sake of Tesla being able to bail out xAI, rather than to get votes for his $1 trillion pay package.

Acquisition of xAI is unlikely: It’s doubtful that Musk would want to do a 100% takeover of xAI, currently valued at $200 billion or 14.2% of Tesla’s market cap, as its $13 billion of 2025 cash burn (which will likely double from here) would quickly blow a hole in Tesla’s balance sheet. If Musk is foolish enough to think that owning xAI would increase Tesla’s already insane valuations, then I’m wrong.

Expect multiples of Musk’s previously floated $5 billion stake in xAI: Last July, Musk posted a poll asking whether Tesla should invest $5 billion in xAI, and 68% of respondents voted “yes”. Below, I explain why this is a drop in the bucket compared to how much Musk will likely have Tesla invest in xAI, given its immense cash needs.

xAI is the most highly valued AI company: Based on its own 2029 revenue targets of $14 billion, xAI has a price/sales multiple of 14x, which is higher than OpenAI’s 5x and Anthropic’s 8x (see Figure 1).

Expect more shareholder lawsuits: There’s already one shareholder lawsuit against Musk, which claims that he diverted Tesla resources—including Nvidia GPUs, talented AI staff, and Tesla data—to xAI without compensation. The fact that it’s being heard in the Delaware Court of Chancery makes it serious, and there could be more like this if Tesla takes a big stake in xAI at its current nosebleed valuations. This is also why the Tesla Board is not recommending a vote of “yes” or “no” on this proposal.

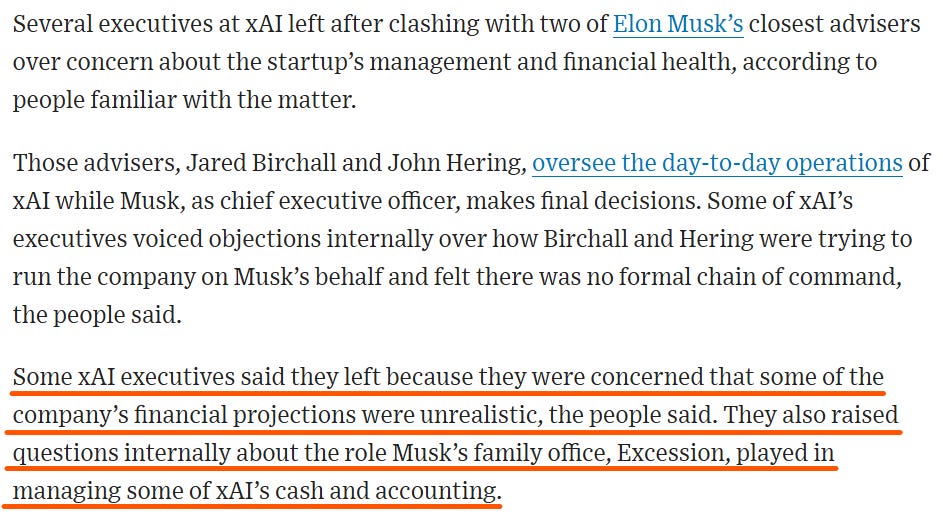

xAI’s financials are not to be trusted: As the Wall Street Journal reported last week, some executives quit xAI due to their concerns about unrealistic financial projections and dodgy accounting.

Why xAI needs a bailout from Tesla like SolarCity did: Cash burn of $13 billion this year is likely chicken feed compared to how much it could swell from 2026. While xAI told investors this month that its capex plans are $18 billion through 2029, this is highly understated, with the actual funds needed to complete current projects closer to $35 billion (see details below).

Weak demand from investors: As explained below, June’s funding round may have been weak due to Musk’s fallout with Trump, but this month’s funding round was also weak, with more debt issued at 12% yields.

This is likely Musk’s last stock pump: After Tesla invests in xAI, there are legal liabilities that could crush Tesla in terms of punitive damages, and possibly render FSD as a low-grade driver-assist system.

====================================================================

Musk is Bored With Tesla

While many believe that Musk is pumping Tesla’s stock to high heaven so that shareholders vote for his proposed $1 trillion pay package on November 6th, it’s more likely that approval for Tesla to invest in his AI start-up, xAI, is of the utmost importance (see details in these last 2 reports here and here).

The proposed $1 trillion performance award for Musk is more of a stock pump to get the rally going and put investors in a favorable enough mood to vote “yes” on the shareholder proposal for Tesla to invest in xAI.

Musk’s ego demands that he’s a key player in AI, which is the biggest stock market boom since the Internet bubble in 2000, and he’s also likely kicking himself for having left (or ousted from?) OpenAI in 2018.

It also probably irks him that his arch-rival, OpenAI’s CEO Sam Altman, is a key partner in the Trump Administration’s $500 billion Stargate project and regarded by Trump as “a very brilliant man”. So, xAI growing is not only a way to make Musk look smart again (after running Tesla into the ground), but if it becomes bigger than OpenAI, it’s the ultimate form of revenge for him.

Musk sees the writing on the wall for Tesla’s car business:

No new models cause increasing pain: Having no new models in the pipeline will require increasing discounts for Tesla’s existing, aged model lineup.

Refreshes don’t work: even the Model Y’s refresh couldn’t stop a 10% YoY drop in China sales since it was fully ramped up in March.

The competition finally matters: Tesla is losing share in every EV market around the world as its old models lose out to flashier and more sophisticated new EVs. Tesla has essentially become the Blackberry of the EV sector, which Musk could’ve avoided with proper attention to product planning.

Robotaxis aren’t close to becoming commercialized: Despite the big fanfare over Tesla’s manned “robotaxi” launches, Musk knows that Tesla isn’t close to being able to operate a driverless ride-hailing business (see details in this report). Investors could lose patience and sell Tesla if his excuse for why Tesla’s “robotaxis” still require safety drivers after December doesn’t go over well on January’s Q4 2025 earnings call.

Cash burn from Q4 onwards is unavoidable: Given all of the above, and the possibility of a recession at least in the auto industry, Tesla will be burning cash and likely need to finance in the near future. It wouldn’t be surprising if Musk leaves Tesla for xAI if things get really bad.

Why the 2025 CEO Performance Award is Simply a “Pump”

Regarding Musk’s proposed $1 trillion award package, some think that all he needs to do is keep juicing the stock via the options market to hit some of the required market cap milestones. But if Tesla is burning cash from Q4, it will be harder for Musk and his traders to manipulate Tesla’s stock via the options market. Keep in mind that juicing Tesla’s stock with call buying only works if there are positive catalysts on which to pump the stock.

The robotaxi theme was extremely useful in propping Tesla’s stock up this year amid increasingly bad earnings and alarming news of huge losses related to Autopilot wrongful death lawsuits (one $243 million loss in a Florida court in August, and two settlements just weeks ago). But unless Tesla can start generating cash by operating a driverless ride-hailing business, this “robotaxi” theme has likely run its course (see a recent deep-dive into how far Tesla is from robotaxis here).

It would be a daunting task for Musk and his traders to jack Tesla’s market cap up to the $8.5 trillion milestone called for in his $1 trillion pay package while the car business is burning down. The operational milestone of adjusted EBITDA of $400 billion (21x Tesla’s peak adjusted EBITDA of $18.7 billion in 2022) also makes little sense: even if Tesla solves FSD and sells humanoid bots, it may not be soon enough to prevent Tesla from becoming a distressed credit play again.

This is why the current rally in Tesla’s shares—despite the extremely dark outlook and looming legal liabilities—is likely the last time Musk can use Tesla as his piggy bank. Hence, the high possibility of Musk getting Tesla to make a sizeable investment in xAI.

Why xAI Needs a Bailout From Tesla

xAI has raised around $32 billion over 5 funding rounds since late 2023, with the first “seeding round” in November 2023 valuing it at $673 million, and the most recent round boosting its valuation from $113 billion in June to $200 billion as of mid-September. But the last 2 funding rounds weren’t easy, and here is a brief rundown:

The June funding round was an epic failure: xAI was cash-strapped as of April after having burnt through $10 billion worth of cash it raised in the previous 11 months, so it set out to raise $20 billion at a $200 billion valuation. After nearly 2 months of marketing, xAI was only able to raise $10 billion at a $113 billion valuation. It saw only $3 billion in equity investments, which led to SpaceX having to pitch in $2 billion, while xAI was forced to issue $5 billion in junk bonds and other high-yielding debt at 13% rates.

September’s funding was still wobbly: Around September 12th, xAI completed another $10 billion funding round, which valued it at $200 billion (Musk, for some reason, said this was “fake news”). It was once again $5 billion in equity and $5 billion in high-yielding debt (much of which was offered at 700 bps above the 4.13% secured overnight financing rate, or “SOFR”). Morgan Stanley drummed up demand for the high-yield debt, but the deal was only 1.5x oversubscribed, a sign of tepid demand.

Friends of Elon bought the equity both times: Both the failed June funding round and this month’s capital raise saw the same “friends of Elon” as equity investors: Andreessen Horowitz, Sequoia Capital, Fidelity, Saudi Arabia’s PIF, and Fidelity. These were also the key investors in Twitter’s LBO in 2022. And Musk made that investment whole somehow through the powers of being in the White House, when xAI bought Twitter (X) for $33 billion last March, the same valuation at which they all bought into the deal, despite investors like Fidelity having marked its investment in Twitter down by over 70%.

The fact that only the Friends of Elon with money to burn tossed a few coins into both deals is a red flag, as is the fact that Morgan Stanley’s xAI debt offering was only 1.5x oversubscribed (if interest rates are declining, 700 bps above SOPR, or 11%, should see higher demand). If Tesla buys a stake in xAI despite these warning signs and at xAI’s current nosebleed valuations (see Figure 1), the more rational shareholders of Tesla could sue to high heaven. This is likely why Tesla’s Board has refrained from recommending this vote.

The fact is that xAI is overvalued, even on its own projections (which shouldn’t be trusted). Figure 1 shows the current valuations of xAI, OpenAI, and Anthropic versus their 2029 revenue forecasts (Anthropic’s revenues are Street estimates, as it doesn’t disclose its target).

Figure 1: xAI is the Most Highly Valued AI Company

Source: Company data and various news sources.

Furthermore, Musk is seen as a risk by many investors, which is why he attracted little new money during the last two funding rounds. And it’s not surprising, given the huge turnover at xAI in just a few months:

June: Co-founder Christian Szegedy, formerly from Google and 1 of the 5 xAI co-founders, leaves.

July 10th: Head of infrastructure and engineering, Uday Ruddarraju, left xAI after having overseen the development of the Colossus supercomputer and training of Grok 3. He was poached by OpenAI.

July-End: Chief Financial Officer, Mike Liberatore, left xAI after having only joined in April. This wasn’t widely known until the Wall Street Journal came out with an exclusive report on the ordeal on September 3rd.

August 7th: xAI’s General Counsel, Robert Keele, quit after just over a year to “spend more time with his two toddlers”.

August 13th: xAI Co-Founder, Igor Babuschkin, announced he was leaving xAI. He came from Google’s DeepMind AI research lab and OpenAI, and said he was starting his own venture-capital business to invest in AI safety.

August: Senior lawyer in charge of commercial affairs, Raghu Rao, also left along with Keele and Babuschkin.

The Wall Street Journal had a great scoop on September 17th about how chaotic the operations at xAI are, with Musk’s chief trader, Jared Birchall (the man who runs all the gamma squeezes in Tesla’s options market that spike Tesla’s stock), cooking the books at xAI. This apparently led to more executives leaving Musk’s AI firm (excerpt from the article in Figure 2).

Figure 2: xAI Also Has Dodgy Accounting

Source: Wall Street Journal exclusive, “Executives at xAI Clashed With Musk Advisers Before Departing” (Sep-17, 2025).

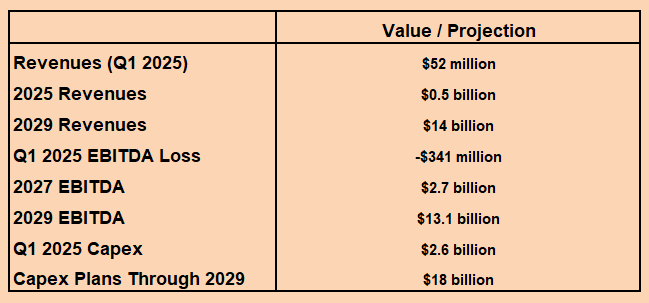

Given the fact that a fraudster like Jared Birchall is “managing” some of xAI’s cash and accounting, the recent numbers given to xAI debt investors earlier this month should be highly suspect. And while I haven’t seen the pitch book that Morgan Stanley used to market the debt offering, I used Gemini to find whatever data from the pitch book was leaked to the media (apparently, only investors with a minimum amount of $50 million were allowed to see the presentation package).

Figure 3: Recently Disclosed Financial Data From xAI

Source: Various news sources via Gemini.

Aside from the 2025 revenue plans being cut by 50% to $500 million since its June funding round, the key red flag in xAI’s recent plans is its capex forecast of $18 billion through 2029. This is extremely understated, if not a bald-faced lie, for the following reasons:

Going from negative to positive free cash flow (FCF) is one of the most important data points for investors in startups, so showing capex plans that are lower than what’s actually needed is a good way to imply FCF will be positive sooner.

xAI is expected to burn $13 billion of cash in 2025, and should be much higher in 2026, given the ramp-up of xAI’s second data center, “Colossus 2”, from Q2 2025.

GPU capex alone is at least $25 billion: On July 22nd, Musk tweeted that Colossus 2 will see its “first batch of 550k GB200s & GB300s, also for training, start going online in a few weeks”. A rough estimate of the cost of 550,000 Nvidia GPUs of this caliber is at least $25 billion.

Maintenance capex for Colossus 1 seems to be omitted: Considering GPU failure rates, upgrade needs, infrastructure refreshes, etc., the maintenance capex for Colossus 1 (with its 220,000 GPUs) is around $2 billion per year.

xAI needs $35 billion of capex through 2029: Given the minimum cost of $25 billion for xAI’s 550,000 GPU needs for Colossus 2, and annual maintenance capex of $2 billion for Colossus 1, xAI needs at least $35 billion for capex between 2025 and 2029. They didn’t state this in their pitch book for investors in their recent $5 billion debt offering, as it would’ve scared all bond investors away. This is fraud.

Tesla Will Likely Invest $40 Billion Into xAI

The capex needs for xAI through 2029 are at least $35 billion, based on my estimates noted above, and cash burn should be much higher unless revenues of only $500 million this year grow much faster from 2026. Ironically, at xAI’s current valuation of $200 billion, the most Tesla could invest without having to include xAI in its consolidated financials happens to be around $40 billion.

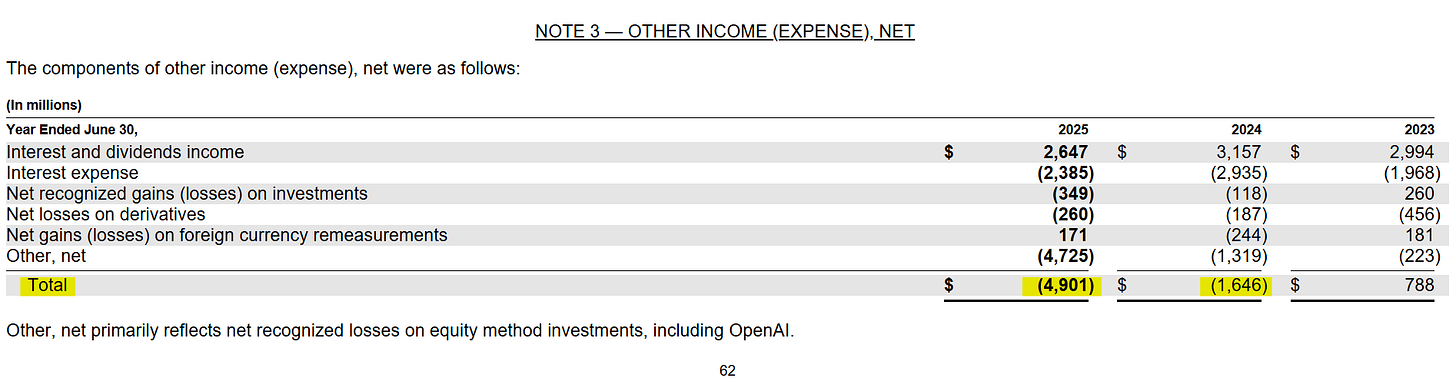

Figure 4 shows Microsoft’s non-operating income accounts from FY2023 through FY2025 (June fiscal year-end). The line item highlighted in yellow mostly includes its equity-method income account, which is its 49% share of OpenAI’s losses.

Figure 4: OpenAI Losses Booked at Microsoft Since FY24

Source: Microsoft.

Usually, if a company has a 20% or higher stake, or a controlling voting interest in another company, accounting rules call for such investments to be booked under the equity-method income account.

The fact that Musk has control over xAI will be an interesting point in terms of how Tesla’s auditors choose to treat Tesla’s investment, even if it is under a 20% stake. Even if Tesla tries to avoid the 20% threshold by only buying up a 19.49% stake in xAI, or $39,980, Musk having full control over xAI could be a problem.

While xAI hasn’t disclosed forecasts of its 2025 net loss, its estimate of $13 billion of cash burn indicates a net loss of around $10 billion. If Tesla had to book 20% of that under equity-method income, it would’ve nearly halved its 2024 non-GAAP net profit of $4.3 billion, ex-credits, although this would be a non-cash item in the cash flow statement.

Final Point: Normally, This Would Be Illegal

While Apple used to have the highest percentage of retail investors in its shareholder base at 38%, Tesla is now higher at 42%. And Tesla’s retail investors have a cult-like devotion to Elon Musk, which is why every proposal on the November 6th proxy will be voted on in Musk’s favor, as it always has been.

Aside from the absurdity of a $1 trillion pay package if certain milestones are achieved (Jeff Bezos had no such incentives all the way down from his founder’s stake in Amazon to his current 9% holdings), Musk using his servile shareholder base to approve a big investment to bail out xAI is sleazy, to say the least. And it should be illegal, given how it was formed with Tesla resources that are now needed, given Musk’s claim that Tesla is an “AI and robotics company”:

Musk poached top Tesla staff to launch xAI.

Musk diverted hard-to-obtain Nvidia GPU orders from Tesla to xAI in 2023.

And Musk did this all while telling Tesla investors that they shouldn’t be invested in Tesla unless they saw it as an “AI and robotics" company, as he proclaimed first on the Q1 2024 earnings call in April 2024.

I have high confidence that Tesla’s stock will be ramped up as high as possible until not only the November 6th shareholders vote, but as long as it takes thereafter to either issue $40 billion worth of shares to buy a 19.49% stake in xAI, or do a share swap for that amount.

And while $40 billion may sound way too high (I could be totally wrong), it’s the proper amount if shareholders approve, given xAI’s huge cash needs amid lukewarm investor interest, while Tesla’s market cap is near all-time highs (at its current share price of $440, a $40 billion stake in xAI would only present around 2.7% dilution).

And this may likely be the last time Musk can tap Tesla’s gargantuan market cap to pay himself, as Tesla could soon face the repercussions from the California DMV’s lawsuit against its fraudulent marketing of Autopilot and FSD. The closing briefs for this trial are due on October 27th, from which date the judge has 30 days to make a ruling. If Tesla loses, the knock-on effect will be huge: it not only turbo-charges an existing FSD class action in California, but it could prompt other blue states with strict consumer fraud statutes, like New York, Massachusetts, and Illinois to follow suit.

This presents the opportunity to ride it up and send it down.

AI Judging AI

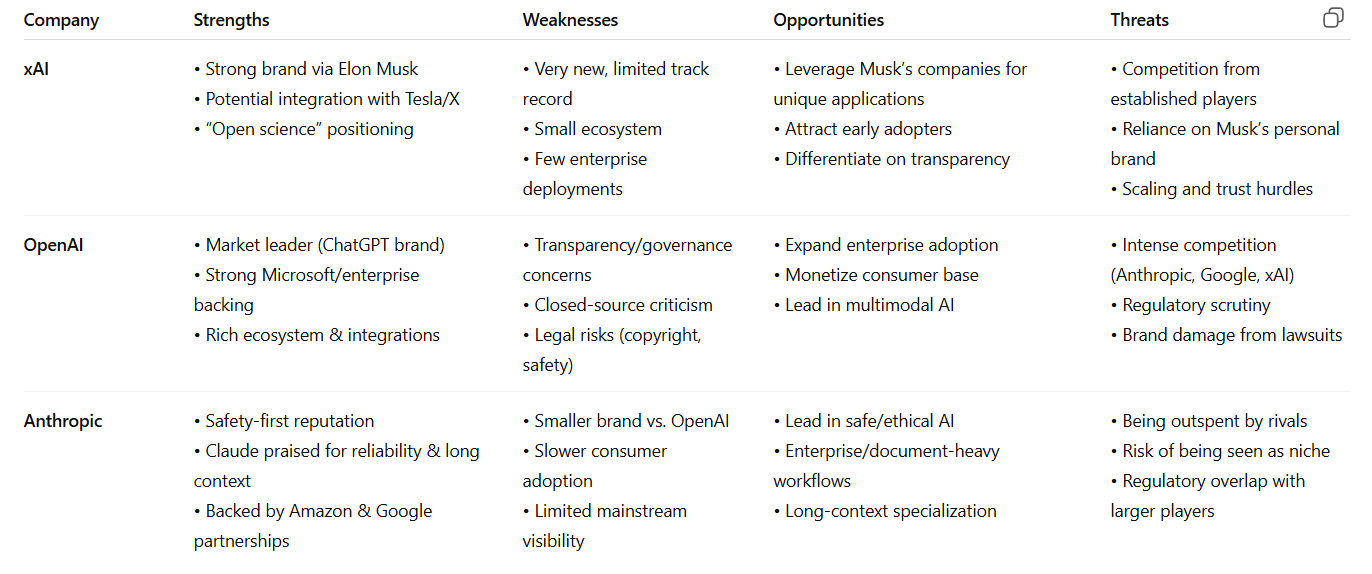

Figures 5 through 8 below show the Strengths, Weaknesses, Opportunities, and Threats (SWOT) analyses of xAI, OpenAI, and Anthropic. I thought it would be interesting to see how ChatGPT rates itself among its 2 big rivals, as well as how xAI’s Grok does it. I included the analyses of Google’s Gemini and Microsoft’s Copilot. After looking at each analysis, it’s hard to see how xAI would be attractive at current valuations. Here are the key points a novice like myself noticed:

ChatGPT had the most balanced analysis of itself and its rivals.

Gemini had some very insightful views on xAI’s weaknesses (Elon Musk being a risk), and threats (reliance on Twitter, or X, data could present significant bias and quality issues).

Copilot suggests that Anthropic’s valuation of $183 billion versus 2025 revenues of $5 billion is high. In terms of price/sales multiples based on 2025 revenues, xAI is the highest at 400x, while Anthropic is the cheapest, at 37x, and OpenAI is in the middle at 42x.

Grok is oozing with bias: Note that all of OpenAI’s weaknesses are just as bad, if not worse, at xAI. In the weaknesses section of Anthropic, the point about its “lag in revenue growth” is quite rich, given that xAI revised its 2025 revenue forecasts down from $1 billion to $0.5 billion in its recent funding round.

Figure 5: ChatGPT’s SWOT Analysis of xAI and Its Rivals

Source: ChatGPT.

Figure 6: Gemini’s SWOT Analysis of xAI and Its Rivals

Source: Gemini.

Figure 7: Copilot’s SWOT Analysis of xAI and Its Rivals

Source: Copilot.

Figure 8: Grok’s SWOT Analysis of xAI and Its Rivals

Source: Twitter.

That's all very interesting. You did a lot of work, thanks. The amount of financial risk amassed in everything AI is unbelievable.

But I think the pay package is important as a "story" because it helps to pump the stock price. Fans will think that Musk can "do it again", so they buy more stock. It's not possible without their help, I think.

I agree completely that Musk has lost interest in EVs since some time.

Incredible that they are able to project with a straight face 13.1 billion EBITA on 14 billion USD revenue in 2029.

There is no reality where that is possible. And EBITA is a joke in that context anyway as interest payments are probably their biggest expense. Not that I belive xAi will survive that long. But who knows. The Saudis are known to throw good money after bad.