Tesla's Robotaxi Sham Could Unravel On Regulatory Hurdles

Even if Tesla hits Level 4 autonomy today, it would take 5 to 7 years to obtain permits in half of America's top 10 ride-hailing states, belying Musk's confidence in driverless services next year.

Looking at the process of obtaining driverless ride-hailing permits in California and other big robotaxi states is eye-opening: the process takes around 5 to 7 years of rigorous testing and data collection.

Most analysts value Tesla’s robotaxi business on 2030 to 2035 estimates, and it’s pretty clear they’re not looking at the regulatory landscape. It’s also strange that Tesla hasn’t even started the process in the easy states like Nevada, Arizona, and Florida.

Musk’s confidence in Tesla robotaxis was always doubtful, but it’s starting to look like it’s a sham to keep the stock price elevated.

Waymo, Zoox, and Cruise took 7 to 9 years to get robotaxi permits: While Musk is making projections of Tesla robotaxis reaching half of the US population by the end of this year, it’s extremely odd that Tesla hasn’t begun the permitting process anywhere. Texas doesn’t count, as new autonomous vehicle regulations nullify the permits Tesla already received (see Section 1).

Level 4 autonomy needed in most states and Tesla is far off: Even if Tesla’s FSD hit Level 4 autonomy today, its permitting process would still take years in most of the US. But the Austin rollout of Tesla’s “robotaxis” with safety drivers in the front seat showed that FSD is still not at Level 4. In fact, despite using a 6-month more advanced version of FSD than what’s available for customers, the 11 disengagements in the first 4 days imply Tesla was at only 20 miles (33 km) before disengagements. Waymo reached 17,311 miles (27,698 km) per disengagement in 2023, before going commercial in 2024.

Tesla’s Cybercab can’t go into volume production under recently streamlined safety standards: Musk keeps saying that the Cybercab will be in “volume production” next year and Tesla even mentioned on the Q1 earnings call in April that they were in B sample validation, meaning mid-stage development. But the Cybercab will need a special exemption from federal safety standards due to having no steering wheel or pedals. Despite Musk having gotten NHTSA tamed so that his FSD and robotaxi ambitions were unhindered, the exemption that Zoox received for its autonomous vehicle earlier this month shows that production is capped at 2,500 vehicles per year for 2 years. While this seems impossible, even Musk’s AI (Grok) confirmed that Musk will need to get the rule changed (Section 2).

Texas isn’t a relaxed robotaxi state anymore: Two days before Tesla’s robotaxi rollout in Austin, Governor Abbott signed a bill in a show of support for its new regulations on autonomous vehicles, which prioritize safety. Tesla will now need to get the Texas Department of Motor Vehicles to agree that FSD is a Level 4 automated driving system, which is what the new law clearly requires. While Musk is said to have free rein in Texas, it will be interesting to see how things unfold in light of the detailed language in the law known as Senate Bill 2807 (Section 1).

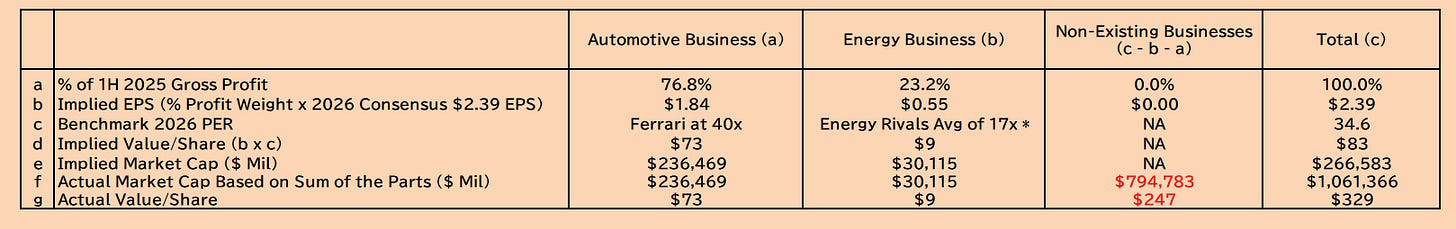

Tesla’s auto business on Ferrari multiples is worth $73 per share and Energy is worth $9 on 2026 consensus estimates, implying that the remaining $247 per share of excess value ($795 billion) is attributed to Tesla’s robotaxi business. Recent Wall Street reports come up with similar numbers. If the above hurdles can’t be tackled by Musk’s political power (state permits are a tough call in big ride-hailing markets like California, New York, Illinois, Massachusetts, and Washington, which make up 40% of the US market), the downside in Tesla’s stock could be huge.

Auto business will burn cash from Q4 onward, which is why Musk is making a big show of Tesla robotaxis to prop up the share price: With the removal of ZEV credits after this quarter, Tesla stands to see a significant drop in earnings, as they made up 49% of 1H net profits. Combined with increasingly weak demand and pricing, Tesla will be burning cash. This is likely why Musk has gone to the extent of rolling out robotaxis with safety drivers in the front seat.

The Robotaxi Pump May Be Starting to Run Thin

Musk has been predicting that Tesla will have self-driving cars “next year” for the past decade, yet its Full Self-Driving (FSD) product isn’t “fully self-driving” at all, and Tesla had to rename it to “FSD (Supervised)” in March 2024 for legal reasons. Musk has also talked about Tesla operating a fleet of “robotaxis” using its FSD technology since 2016, with bold predictions at an event called “Autonomy Day” in April 2019, that Tesla would have 1 million robotaxis on the road by the end of 2020. Eight trading days later, Tesla issued $2.35 billion in stocks and bonds and never rolled out the 1 million robotaxis Musk had discussed on Autonomy Day.

Musk began to really push the Tesla robotaxi theme hard in early 2024, as profitability deteriorated due to continued price cuts to support its old model lineup. This led to negative free cash flow in Q1 2024 for the first time in 4 years, and the stock had dropped by 43% leading up to the earnings release on April 23rd.

On the Q1 earnings call, Musk went into full-pump mode on how FSD version 12 is close to exceeding human driving reliability and how Tesla’s growing AI infrastructure would power its robotaxi fleet made up of the “Cybercab”, which would debut later that year. Tesla shares rallied by 12% the next day and were up by 34% 5 days later when Musk had a surprise visit to Beijing, where he was said to be seeking approval to launch FSD in China.

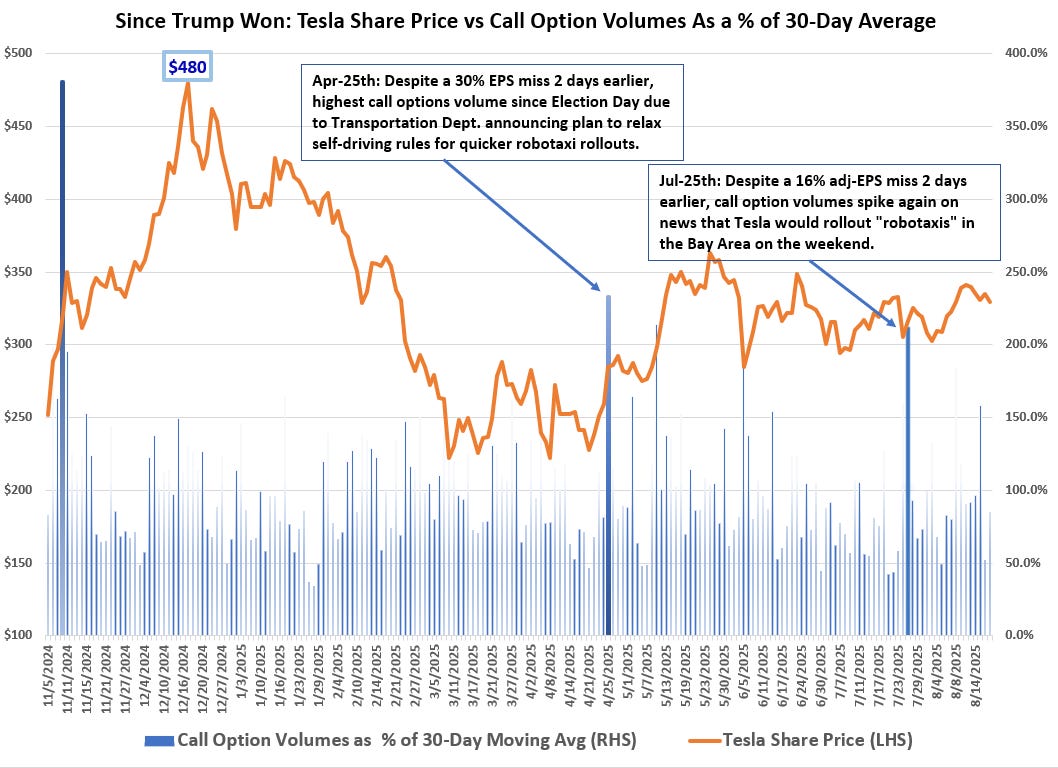

This “robotaxi” pump has become Musk’s weapon of choice to keep Tesla’s stock price elevated, and despite a further 32% drop in EPS during the 1H of 2025, Tesla is trading around $330, or 70% higher than where it was after the bad Q1 2024 results. Note that after bad Q1 and Q2 results this year, a sell-off in Tesla shares has always been countered by news related to robotaxis. Figure 2 below shows how the two largest days of call-buying volumes this year just happened to come after horrible Q1 and Q2 earnings results that led to rallies due to news catalysts about Tesla robotaxis.

Figure 1: Robotaxi News Dispels Bad Q1 & Q2 Earnings

Source: Bloomberg.

With earnings in free fall and the stock being propped up by constant Tesla robotaxi news, its valuations have become even harder to explain than ever, as there are no earnings from robotaxis.

Even with generous assumptions like the Street’s 2026 EPS estimates of $2.39 for Tesla (highly unrealistic) and Ferrari’s 2026 earnings multiple of 40x, Tesla should be worth only $83 per share on a sum-of-the-parts basis (see Figure 2). Yet the stock trades at $329, which means that $247 per share, or $817 billion of “excess” value, is attributed to Tesla’s robotaxis (few analysts factor in Tesla’s humanoid bot project, which has stalled).

Figure 2: Sum-of-the-Parts Implies Robotaxi is $247 Per Share

Source: Bloomberg; * Energy rivals include Fluence, NextEra, & Enphase.

RBC Capital published a report on August 17th estimating that Tesla’s robotaxi business is worth $649 billion based on the assumptions of 3.75 million robotaxis deployed in 2030, which would generate $100 billion in revenues at a 30% EBIT margin. The analyst values this at a 20x EV/EBIT multiple.

The Tesla robotaxi “believers” not only see Tesla hitting Level 4 autonomy soon, but they point to the following advantages that will allow Tesla to take market share from Uber, Lyft, and Waymo:

Tesla will have a cost advantage by mass-producing their robotaxis (Waymo has to buy theirs), using an inexpensive “vision-only” camera system instead of expensive radar and LiDAR sensors like Waymo. This will allow Tesla to scale their fleet faster than Waymo and others.

A lower cost base is expected to allow Tesla to largely undercut its rivals in fares, which is estimated to be around $0.40/mile ($0.25/km) versus legacy ride-hailing companies like Uber and Lyft at around $2.50/mile ($1.56/km).

Tesla’s charging infrastructure and its Megapack energy storage system will also reduce costs relative to rivals.

Tesla owners who have FSD on their cars can enter them into Tesla’s robotaxi fleet and make money, while Tesla takes a 20%-30% commission, in an Airbnb-type structure.

The problem is that Tesla is nowhere near obtaining approval to operate a driverless ride-hailing business anywhere and even faces hurdles in Texas, where new autonomous vehicle laws go into effect on September 1st (more details below).

Even if Tesla were to reach Level 4 autonomy tomorrow, the data gathering and testing to obtain all the permits would still take around 5 to 7 years in half of the top 10 ride-hailing markets in the US. This

blows RBC Capital’s fair value estimate of $649 billion for Tesla’s robotaxi business to smithereens, as they assume Tesla will hit $100 billion in robotaxi revenues by 2030.

Despite Musk having said on the Q2 earnings call that Tesla will have robotaxi services available for half the US population by the end of this year, Tesla hasn’t even started the application process in the “easy” states like Nevada, Arizona, and Florida.

This is why Musk’s sudden rush to roll out “robotaxis” with drivers to Texas and California, despite FSD being nowhere near Level 4 autonomy, seems more like a dog and pony show to keep Tesla’s stock price propped up as its auto business deteriorates at an increasingly faster rate. The launch of Tesla’s “robotaxi service” in Austin last June exposed just how flawed FSD still is, after years of development.

There were around 15 Model Ys in Austin, with an FSD version that was 6 months more advanced than what’s currently available for customers. Despite Musk having said on the Q1 earnings call in April that Tesla was “on track to be able to do paid rides fully autonomously in Austin in June,” in the end, there were Tesla employees in the front seat to take over if things went wrong (more proof that FSD isn’t fully autonomous). And thankfully so, as there were 11 disengagements caught on camera by passengers and circulated on social media in the first few days (great article by Reuters about this here).

Thirty-one days after the Austin launch on the Q2 earnings call, Tesla’s VP of AI and Software mentioned that the Austin robotaxi fleet had logged 7,000 miles (11,200 km) since the June 22nd launch. This implies that, if the 11 disengagements reported in the first 4 days were the only ones during the 7,000 miles logged in 31 days, Tesla’s robotaxis can only drive 636 miles (1,018 km) before human intervention is needed. Adjusting for 11 in 4 days gives you a paltry 20 miles (33 km) per disengagement. Last September, the independent automotive research firm, AMCI Testing, said their drivers on average saw only 13 miles (21 km) per disengagement (link here). (Waymo was logging 17,311 miles (27,698 km) per disengagement during testing with drivers in 2023.

Regarding the 7,000 miles logged by Tesla’s robotaxis in Austin, Tesla’s AI chief said there were “no notable safety-critical incidents”. This was a bald-faced lie, as there were safety-critical interventions to stop Tesla robotaxis from crossing the tracks as a train was approaching, swerving into the opposite lane for 6 seconds (see Video 1 below), slamming on the brakes so hard that it could’ve caused a rear-end collision (see Video 2), and making illegal left turns (video here).